160 years of partnership and global connectivity

HSBC has been supporting customers in Japan since opening our first branch in Yokohama in 1866. The bank has had a continuous presence in the country for 160 years supporting Japanese businesses both locally and internationally.

Opening the Yokohama office

As Japan’s international trading economy began to expand rapidly from the mid-1800s. HSBC’s founder, Thomas Sutherland, was instrumental in establishing a P&O steamer service running between Hong Kong to Yokohama and Nagasaki in 1864. The increase in regional and international trade links brought new opportunities for businesses in the area - including HSBC.

HSBC was one of the first foreign banks to operate in the country, opening its first branch in Yokohama in 1866. HSBC and these other pioneers were crucial in financing the country’s rapidly growing trade with the wider world, particularly the highly prized silk trade. HSBC was especially well-placed to support this business through its global network of offices which included Lyon – the European centre of the silk trade.

Expansion and trade across Japan

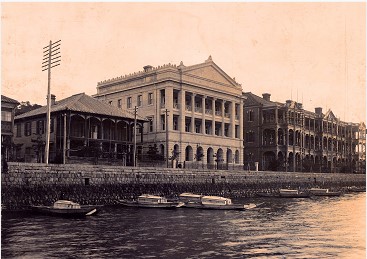

The office in Yokohama was followed by branches in Kobe (1869), Osaka (1872) and Nagasaki (1896). Our former building in Nagasaki still stands proudly overlooking the Nagasaki harbour front. After surviving wars, earthquakes and typhoons, today, it’s the oldest HSBC purpose built branch building still in existence anywhere in the world, according to Group archival records.

In addition to financing trade, HSBC also helped to carry out large bullion operations for the mint at Osaka and lent money to Japanese companies.

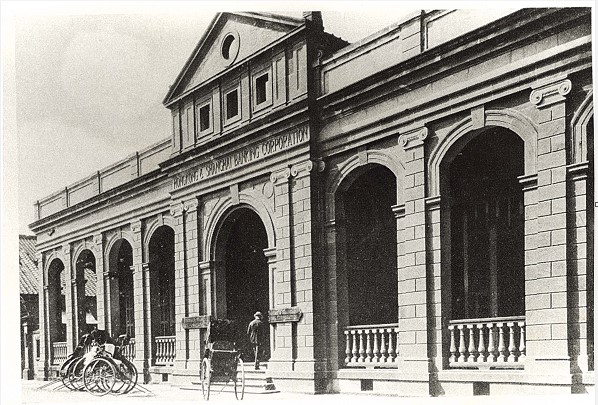

HSBC provided a model of modern banking and Japan’s first bank with overseas operations, the Yokohama Specie Bank, is said to have modelled its constitution on that of HSBC. The bank also provided the Japanese government with assistance over currency reform.

In the late nineteenth century the most commonly used currency in Japan was the Mexican silver dollar. However, in 1879 the Japanese authorities decided to introduce the silver Yen as a credible alternative. HSBC encouraged this development and the Yokohama branch manager announced that the bank would accept the silver Yen at par with the Mexican dollar.

In Hong Kong, Thomas Jackson, the Chief Manager of the bank, also championed the cause of the Yen, helping to instill confidence in the new currency. This consistent backing was considered so important by the Japanese authorities that in 1912, the Yokohama branch manager was decorated personally by the Emperor of Japan with the Order of the Rising Sun for his services to the development of Japan’s currency.

Between 1897 and 1930 HSBC was also involved with some GBP50 million worth of loans to the Japanese government and cities. These loans were used to fund railway construction, waterworks and harbour construction as the country transformed itself into a modern industrial powerhouse.

A Japanese bond issued in 1905 proved so extremely popular with investors that crowds making applications at the bank’s London office were so large and unruly that the bank’s rugby team had to be called into action to maintain order.

Great Kanto Earthquake

However, the bank’s success in Japan could not protect it from disasters. On 1 September 1923 a massive earthquake struck Yokohama, causing widespread destruction across the city.

The bank’s building was all but destroyed and two members of staff were killed. The initial shock was followed by a devastating fire which burned for several days.

The surviving staff salvaged what they could from the wreckage and a temporary branch was established in Kobe, where a ‘Reconstruction Department’ worked to re-establish the balance sheet for the Yokohama branch, which was not to re-open in the city for several years.

Rebuilding after war

After its efforts to rebuild in Yokohama, the bank faced a much larger rebuilding challenge at the end of the Second World War. HSBC was the first foreign bank to send a representative to Japan after the war in 1946.

Developing in the twentieth century and beyond

HSBC’s purchase of the Mercantile Bank in 1959 brought its Japanese branches into the HSBC network. The Mercantile Bank had opened in Japan as long ago as 1863 and operated branches at Tokyo and Osaka. From the early 1960s the banks integrated their branches with the exception of the successful Mercantile branch at Nagoya which remained under that company’s name until 1983.

HSBC reinforced its commitment to Japan in 1998 with the opening of a new main office in Nihonbashi, Tokyo, bringing together all of our business under one roof. The innovative building was the winner of that year’s Nikkei New Office awards.

In 1985 we established a locally incorporated investment services company which evolved into a locally incorporated asset management company in 1998. This then quickly developed into a leading provider of emerging market funds and we were among the first asset managers to offer Japanese retail investors a China, Brazil, and India fund.

Underlying our historic roots, we’ve unrivalled strength and expertise in China. In 2020, we became the first financial institution to offer Japan-based investors access to China’s onshore CNY FX market. This was followed in 2021 by us successfully facilitating the listing of two new cross-border exchange traded funds (ETF) under the China-Japan ETF Connectivity scheme.

As part of our commitment towards sport and the wider pursuit of health and wellbeing and a more inclusive society, through a partnership with the Badminton World Federation we have helped bring world-class badminton to Japan since 2018. We also entered into a partnership with the Japan Rowing Association in 2020.

In 2022 we locally incorporated our securities business with the establishment of HSBC Securities (Japan) Co., Ltd. This demonstrates our long-term commitment to the Japanese market and provides an even stronger platform from which to serve our clients by providing investment opportunities across rates, credit, and derivatives, as well as supporting their hedging and financing needs.

In 2025, we were named the ‘Best Trade Finance Bank’ in Japan, as well as the Market Leader in Product, Technology and Client Service by Euromoney. Furthermore, we were also crowned Japan’s number one Cash Management provider, as well as in the Technology category in Euromoney’s Cash Management Survey.

Building on the roots that we laid down in 1866, today HSBC in Japan continues to offer customers innovative products and services particularly in the areas of asset management, corporate banking, trade finance, cash management and treasury, capital markets, securities and custody services.